In the dynamic realm of finance, a profound transformation is underway, heralding a new era in financial management. This revolution is not just a distant concept but a tangible force shaping the future of wealth management, investments, and financial strategies. From digital advancements to sustainable investing, the landscape is evolving quickly, driven by innovation and changing customer demands. As technology reshapes traditional practices and societal values affect investment decisions, the financial world stands at the cliff of sudden change. Let’s delve into some key trends that are driving this revolution and shaping the future of financial management.

What Is a Financial Revolution?

The financial revolution represents an insightful shift in the way we manage, access, and interact with money and financial systems. Fifty-dollar gold coins’ timeless charm and central value suggest that interest in them will last for generations. This revolution management democratizes the availability of financial services, improves efficiency, and reshapes traditional banking and investment paradigms. It emphasizes personalization, data-driven decision-making and regulatory compliance. The financial revolution empowers global entities, fostering innovation, inclusion, and resilience.

Who Is the Father of Financial Management?

Dr. Peter Drucker is considered to be the father of financial management. He is a renowned management consultant, educator, and author. Drucker’s revolutionary work in the field of management theory and practice laid the foundation for modern concepts of organizational management, including financial management principles. His significant writings, such as The Practice of Management and Management: Tasks, Responsibilities, Practices, emphasized the importance of effective financial decision-making, resource allocation, and strategic planning within organizations. Drucker’s insights keep on shaping the way businesses and institutions approach financial management, making him an influential figure in the discipline.

Why Financial Management Is Important?

Financial management is important because it makes people, businesses, and organizations capable of making better decisions regarding their finances. Financial stability and security can be achieved by effectively managing resources, for example, money, investments, and assets. It enables businesses to allocate funds effectively, increase profits and plan for growth. On a personal level, financial management helps in budgeting, savings and investment strategies, leading to long-term financial health and independence. In addition to this, effective financial management makes sure that it complies with regulatory requirements, minimizes risks, and promotes transparency and accountability. Ultimately, mastering financial management allows people and organizations to achieve their goals, weather economic uncertainties, and build a safe future.

Top Trends Financial Revolutionization in 2024

In 2024, the financial landscape will witness key trends reshaping the industry. Decentralized Finance (DeFi) gains traction, providing alternatives to traditional banking. Tokenization of assets enables fractional ownership and liquidity. Central Bank Digital Currencies (CBDCs) organize transactions. Non-fungible tokens (NFTs) reshape digital ownership. Open banking fosters collaboration and data sharing. AI boosts financial services while sustainability drives investment decisions. Cybersecurity remains a priority in the middle of digital advancements. Contactless payments increase post-pandemic. Regulatory reforms adjust according to technological changes. These trends mark a transformative era in finance, emphasizing innovation, digitization, and sustainability.

Digital Transformation

One of the most significant trends in financial management is the widespread adoption of digital technologies. From mobile banking to online investment platforms, digital transformation is revolutionizing how financial transactions are conducted, making them more convenient, efficient, and accessible to a broader audience. With the rise of fintech companies and digital payment systems, traditional financial institutions are facing growing pressure to innovate and adapt to this new digital landscape.

Data Analytics and AI

Data has become the new currency in finance, and harnessing its power through analytics and artificial intelligence (AI) is revolutionizing financial management practices. By analyzing vast amounts of data in real-time, financial institutions can gain valuable insights into market trends, customer behaviour, and investment opportunities, enabling them to make better decisions and minimize risks. AI-driven algorithms are also automating routine tasks, optimizing portfolio management, and improving the overall efficiency of financial operations.

Blockchain and Cryptocurrencies

The emergence of blockchain technology and cryptocurrencies has disrupted traditional financial systems, offering decentralized and secure alternatives to conventional payment methods and asset management. Blockchain technology, with its immutable ledger and smart contract capabilities, has the potential to organise processes such as cross-border payments, trade finance, and supply chain management, while cryptocurrencies like Bitcoin and Ethereum are challenging the status quo of fiat currencies and traditional investment vehicles.

Sustainable and Impact Investing

As environmental, social, and governance (ESG) considerations take centre stage, sustainable and impact investing has gained momentum, reflecting a growing awareness of the interconnectedness between financial performance and societal well-being. Investors are increasingly looking for opportunities to line up their portfolios with their values, driving demand for investments that promote environmental sustainability, social equity, and corporate responsibility. Financial management practices are evolving to incorporate ESG criteria into investment decision-making processes, recognizing the long-term benefits of sustainable investing.

Personalization and Customer Experience

In an era of heightened competition and evolving consumer preferences, financial institutions are prioritizing personalization and customer experience to differentiate them in the market. By leveraging data analytics and AI-driven insights, banks, wealth management firms, and fintech startups are customizing their products and services to meet the distinctive needs and preferences of every customer, enhancing engagement, loyalty, and satisfaction.

Regulatory Compliance and Risk Management

In 2024, regulatory compliance and risk management stand as pivotal priorities in the financial sector. Stricter regulations demand robust risk management frameworks to ensure integrity and stability. Institutions navigate evolving compliance standards, enhancing transparency and accountability in financial operations. Compliance solutions streamline reporting and mitigate risks, safeguarding against regulatory scrutiny and financial instability. As the regulatory landscape evolves, financial entities invest in sophisticated compliance technologies and strategies to maintain trust and confidence in the marketplace. Efficient risk management practices not only lessen possible losses but also encourage resilience and sustainability in the face of uncertainty.

Tokenization of Assets

Tokenization of Assets is a revolutionary trend in finance, changing traditional ownership models. It involves representing real-world assets, such as real estate, art, and commodities, as digital tokens on blockchain platforms. This process enables fractional ownership, letting investors purchase and trade small portions of high-value assets. Tokenization enhances liquidity by facilitating seamless transactions and reducing barriers to entry for investors. In addition to this, it provides transparency, security, and efficiency in asset management. As a result, tokenization is revolutionizing investment opportunities, democratizing access to assets, and redefining the future of finance.

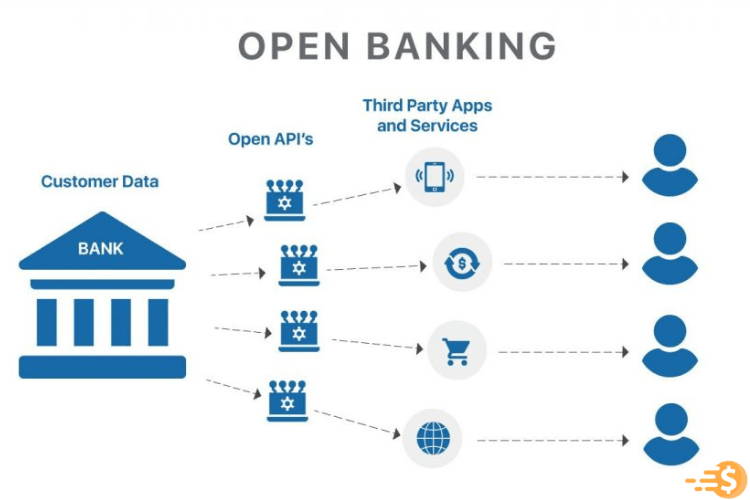

Open Banking

Open Banking, an important trend in finance, promotes transparency and collaboration among financial institutions. It allows customers to safely share their financial data across multiple platforms and services, fostering innovation and competition. With Open Banking, people gain greater control over their financial information, enabling personalized services and improved access to financial products. This initiative revolutionizes traditional banking models, empowering consumers with seamless and mixed financial experiences. By leveraging Open Banking APIs (Application Programming Interfaces), banks and fintech firms can develop innovative solutions that cater to the increasing needs of customers, driving the industry towards a more connected and customer-centric future.

What Financial Management Do?

Revolution Financial management covers a wide range of activities aimed at efficiently and effectively managing an organization’s financial resources. It includes budgeting, prediction, financial analysis, and decision-making to ensure optimal allocation of funds. Financial managers oversee cash flow, monitor financial performance, and develop strategies to increase profitability and shareholder value. They also assess investment opportunities, manage risks, and maintain compliance with regulatory requirements. Additionally, financial management involves raising capital through different means such as equity or debt financing, as well as managing relationships with investors and lenders. Ultimately, the goal of financial management is to increase the financial health and stability of an organization while attaining its long-term objectives.

Conclusion

The revolution in financial management is empowered by a union of technological advancements, changing customer behaviours, regulatory reforms, and societal values. As we navigate the complexities of this quickly evolving landscape, embracing innovation, adaptability, and responsible stewardship will be essential for staying ahead of the curve and utilising the changing power of finance for the benefit of society as a whole. The future of financial management is here, and it’s ours to shape.

FAQs

What are financial management systems?

Monetary management systems are tools or software used by businesses to organize financial processes such as budgeting, accounting, invoicing, and reporting. These systems help organizations manage their finances more effectively, make up-to-date decisions, and ensure compliance with regulatory requirements.

Why financial management is important in business?

Fiscal management is crucial in business to ensure efficient allocation of resources, track performance, and make informed decisions. It helps businesses manage cash flow, control expenses, and maximize profitability. Effective financial management enables strategic planning, supports growth initiatives and improves overall stability and sustainability.

How many wealth management firms are in the US?

In the United States, there are thousands of wealth management firms, ranging from large financial institutions to boutique advisory firms. These firms give a variety of services including investment management, financial planning, estate planning, and retirement planning to individuals, families, and businesses looking to grow and preserve their wealth.